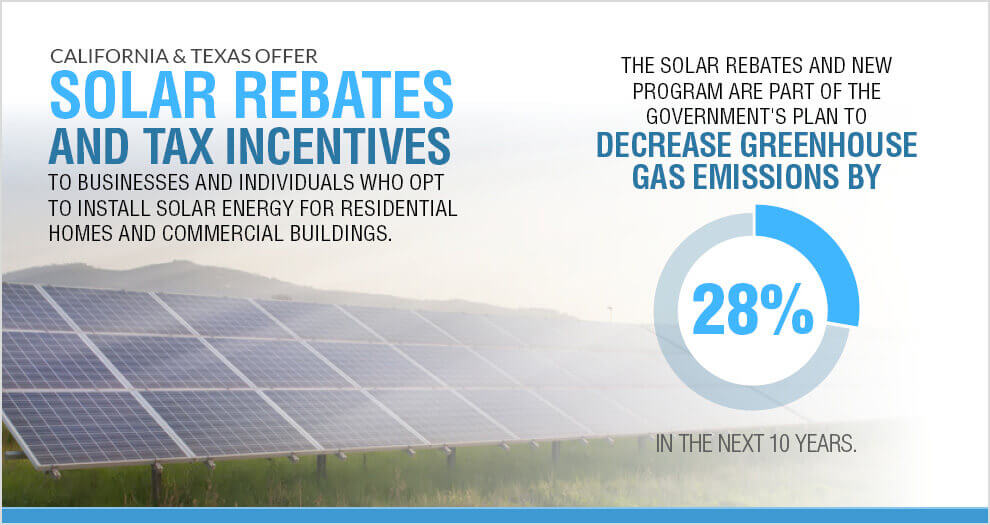

SOLAR REBATES & INCENTIVES

Local & Federal Rebates that can hep you pay for your Solar System Cost!

Solar Rebate for Homeowners

Solar Rebate is the amount of money (or) discount offered by solar energy company to solar shoppers. Rebate is calculated from data based on how much power solar arrays can perform or produce. The basic average rate of local utility solar rebates is approximately about $0.20 to $1.25 per watt. Solar energy company will provide a rebate of $500 to cover the cost of your solar system & permit fee. But homeowners in some particular zip code areas can get solar rebate up to $1000 or more. Accumulated Rebate in the long run can cover 100% of the costs for solar panel installation. All homeowners should be aware of this fact. The rebate is approved after the utility company has granted permission (Known as PTO - Permission To Operate). Normally, PTO is issued within 2-3 business days.

Money savings & Rebate rates vary from region to region. It depends on many factors, such as: (1) How much actual power your system can produce (2) How much your household uses power (3) Geographical condition & weather (4) How much shade you have in your place of home or business & (5) Product type. Experienced local solar installer can provide estimates & offer better rates.

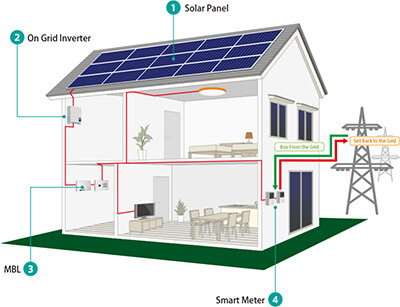

Power Sell Back

When your solar energy system produces power more than your household needs, surplus power can be sent back to the power grids of your electricity provider. In other words, the electricity meter will run backwards to provide a credit for homeowner. This means that you can sell surplus power back to electricity company. By selling back, you can earn credits to your the electricity account. In many states, including California, this process is called "Net-Metering" program (Renewable energy buy back program) sponsored by the state. California is the #1 solar energy state in the USA.

Tax Credits - Solar Incentives

Federal government offers a solar Investment Tax Credit (ITC) to solar home owners. ITC was created in 2005 & U.S.Congress approved ITC in 2016. It has been renewed & extended to 2021 & on (As per Energy.gov). This will reduce 30% of your annual tax return if you own a solar panel system. If your Tax credit is greater than the amount you owe, it can roll over to the next tax year. Note - Federal tax credit not only applies to solar panels, but also to all cost for installation, equipment, mounting material, connecting hardware to the grid & labor charges.

The utility companies &/or municipal agencies in some US states such as California & Arizona, offer cash rebates & incentive programs for solar system installations. If you live in a state which doesn't offer solar rebates, you may still be eligible for Solar Renewable Energy Credits (SRECs). For example - in Texas state, "Green Mountain Energy" (the state's deregulated Retail Electricity Providers) offers a de facto net metering program.

As you see, by Going Solar - You have nothing to lose but everything to gain!

Our Generous offer - Solar Rebates

Attention Homeowners! - iGreen offer the best Solar Rebates, Financing & Installation service to make a solar home. We provide better services than the competitors. We do better than anyone. No sales pressure guaranteed. We are fully licensed, certified & experienced solar installer. We have been serving California & Texas since 2004. We handle everything - installing, permit process & all the HOA communications in Texas. Contact us to find out about our solar rebates, financing, low monthly payment options & low-cost solar panel installation. By Going Solar with us, you can save up to 90% on your monthly energy bills & save money on your Federal Tax & State ITCs.

CALL US TODAY FOR YOUR FREE ESTIMATE (855) 203-3163 OR REQUEST YOUR FREE QUOTE HERE